Last Week Enterprise AI Changed Forever

Anthropic, OpenAI, and Google made moves that will reshape how businesses operate. Here's what happened and what it means for you.

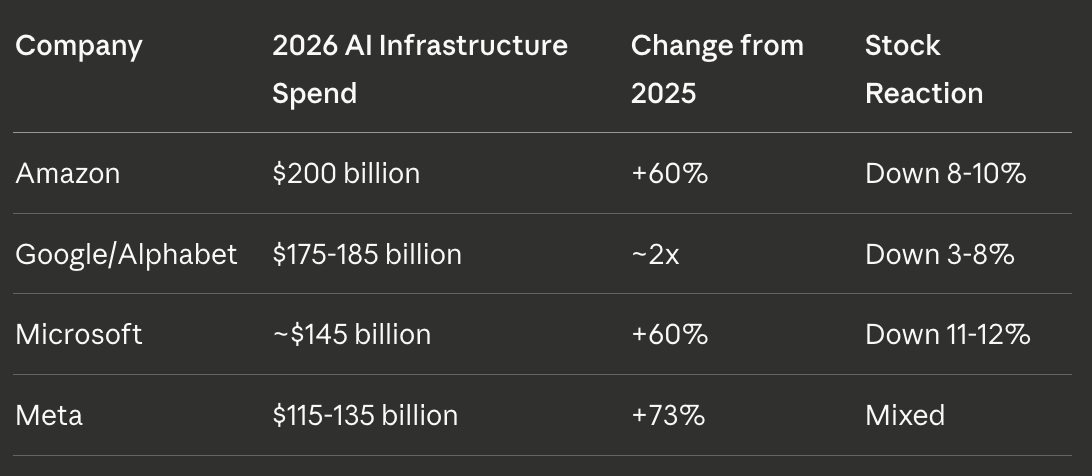

TLDR; Three product announcements. Four earnings reports. $650 billion in infrastructure commitments. A $285 billion selloff.

Last week wasn't just another news cycle in AI. It was the week the enterprise AI race stopped being theoretical and became the largest infrastructure buildout in technology history.

If you’re a business owner trying to make sense of what happened and what to do about it, here’s the clearest picture I can give you.

What Actually Happened

Monday: Anthropic launched Claude Cowork plug-ins.

Anthropic, the company behind Claude, released tools that automate tasks across legal, sales, marketing, and data analysis. Not chatbot features, actual workflow execution.

The market response was immediate: $285 billion wiped from software stocks in a single day. Thomson Reuters dropped 18%. LegalZoom fell 20%. Analysts called software sentiment “radioactive.”

I wrote at the time that the market was asking the right question; can AI replace workflows that software companies charge for? but drawing the wrong conclusion. The selloff assumed AI is a light switch. In practice, it’s a slow migration.

Thursday: OpenAI launched Frontier.

Four days later, OpenAI responded with their most aggressive enterprise play yet: a platform for building, deploying, and managing what they call “AI coworkers.”

Frontier isn’t another chatbot. It’s a bid to become the operating system of the enterprise; a semantic layer that connects your CRM, data warehouse, HR systems, and internal tools, then lets AI agents work across all of them.

OpenAI is deliberately using employment language. These agents get identities, permissions, performance reviews. The framing is intentional: they want businesses to think about AI as staffing decisions, not software purchases.

Wednesday through Friday: The hyperscalers revealed how much they’re betting.

While Anthropic and OpenAI were launching products, the four companies that power most of the internet’s infrastructure announced their AI spending plans for 2026:

Combined: approximately $650 billion in capital expenditures for 2026. That’s more than the GDP of Sweden. It’s a 60-70% increase from what these same companies spent in 2025.

To put this in perspective: a decade ago, these four companies spent $31 billion combined on infrastructure. Now they’re spending twenty times that — almost entirely on AI.

Why Stocks Dropped on Good News

Here’s what confused a lot of people: these companies reported strong earnings. AI demand is high. So why did investors sell?

Two reasons:

1. Cash flow compression.

When you spend $200 billion (Amazon) or $185 billion (Google) on data centers, that money has to come from somewhere. Analysts at Morgan Stanley project Amazon’s free cash flow could go negative by $17-28 billion this year. Meta’s free cash flow is expected to drop by nearly 90%.

These companies are betting that AI infrastructure will generate massive returns; eventually. But “eventually” doesn’t pay dividends today.

2. The return-on-investment question.

Investors are asking: will AI actually generate enough revenue to justify this spending? The demand is real, Microsoft’s AI backlog has doubled to $625 million, largely from OpenAI. But translating infrastructure into profit at this scale is unprecedented.

As one analyst put it: “The skepticism is probably healthier than any previous cycle I’ve seen.”

The Pattern Nobody’s Talking About

Taken separately, last week looks like a collection of different stories: product launches, earnings reports, stock movements.

Taken together, they reveal a single strategic reality: the race to own AI infrastructure, and the enterprise layer that sits on top of it, is now fully underway.

Here’s what each player is betting on:

Anthropic is betting on vertical depth. Their Cowork plug-ins target specific professional workflows; legal, marketing, sales. The approach is modular: become indispensable in high-value niches, then expand.

OpenAI is betting on horizontal breadth. Frontier isn’t trying to be the best at any one workflow. It’s trying to be the coordination layer that manages all your AI agents, including ones from competitors. They explicitly said Frontier works with agents from Google, Microsoft, and Anthropic.

The hyperscalers (Amazon, Google, Microsoft, Meta) are betting on infrastructure dominance. They’re not just building AI products; they’re building the compute capacity that all AI products depend on. If AI becomes as essential as electricity, they want to own the power plants.

These aren’t competing strategies, they’re complementary layers of the same stack. The question is who captures the most value: the model makers (Anthropic, OpenAI), the platform providers (OpenAI’s Frontier, Anthropic’s Cowork), or the infrastructure owners (Amazon, Google, Microsoft, Meta).

The $650 billion bet suggests the hyperscalers believe infrastructure wins in the long run.

What This Means for Business Owners

You might be thinking: I’m not a Fortune 500 company. Frontier is launching with customers including Uber and State Farm. Amazon’s spending $200 billion. What does any of this have to do with me?

More than you might expect.

1. AI capabilities will improve dramatically, and costs will eventually drop.

When four companies are spending $650 billion combined on AI infrastructure, they’re not doing it for charity. They’re building capacity for demand they expect to materialize. That means the AI tools available to your business in 2027 will be meaningfully better than what’s available today.

It also means competition will eventually drive prices down. The current moment high prices, rapidly evolving capabilities is temporary. The hyperscalers are racing to capture market share, and price wars benefit buyers.

2. The “AI coworker” framing is going to become standard at every scale.

OpenAI is training the entire market to think about AI agents as team members, not tools. This changes the conversation from “what software should we buy?” to “what roles should AI fill?”

That reframing will trickle down. Within 18 months, you’ll be evaluating AI vendors the way you evaluate staffing agencies. The question won’t be “does this tool have the features we need?” It’ll be “can this agent do the job we’d otherwise hire for?”

3. Platform consolidation means decisions you make now will have long-term consequences.

When the biggest companies in the world are racing to become your AI infrastructure provider, choosing one means building on their ecosystem. Switching costs will increase. Integration depth will matter.

This doesn’t mean you should wait for a winner. It means you should be intentional about which platforms you’re building dependencies on and maintain flexibility where you can.

4. The “wait and see” window is closing.

The scale of investment last week signals something important: the largest companies in the world believe AI is the next foundational technology. They’re not hedging. They’re going all-in.

If you’re holding off on AI adoption because you’re waiting for things to settle, that calculus is shifting. The businesses that will capture value from these platforms are the ones building AI capability now; documenting processes, cleaning data, experimenting with automation; not the ones waiting for perfect clarity.

What To Actually Do About This

If I were advising a business owner who watched last week’s news and wants to respond strategically, here’s what I’d say:

Start with preparation, not platforms.

The companies that will capture value from Frontier, Cowork, or whatever comes next are the ones with documented processes, clean data, and clear decision logic. If your workflows exist only in people’s heads, no AI platform will help you.

The unsexy work of process documentation is the highest-leverage thing you can do right now.

Build AI capability incrementally.

Don’t wait for the platform wars to settle. Don’t make a massive bet on one provider. Instead, start small: pick one workflow, implement one automation, learn what’s actually involved.

The institutional knowledge you build; what works, what breaks, how your team adapts; is more valuable than any specific tool.

Think in systems, not tools.

The lesson of last week is that the future belongs to integrated systems, not standalone applications. AI that connects your CRM to your data warehouse to your project management tool creates more value than AI that does one thing brilliantly in isolation.

When you evaluate AI opportunities, ask: does this connect to our existing systems, or does it create another silo?

Watch for the pricing shift.

$650 billion in infrastructure investment means these companies are planning for massive scale. When that capacity comes online and competition intensifies, prices will drop and capabilities will rise.

Don’t lock into long-term contracts at today’s prices for today’s capabilities. Build flexibility into your agreements.

The Bigger Picture

Last week was a turning point, but not a finish line.

We’re watching the largest infrastructure buildout in technology history unfold in real time. The combined $650 billion that Amazon, Google, Microsoft, and Meta are investing this year is more than most countries’ GDP. It’s more than the entire global semiconductor industry was worth a decade ago.

This isn’t speculative anymore. The biggest companies in the world are making irreversible bets that AI will be foundational to how business operates.

The businesses that thrive through this transition will be the ones that take AI seriously without taking the hype literally. That means building real capability; documenting processes, cleaning data, implementing automations, developing institutional knowledge ; while maintaining healthy skepticism about timelines and vendor promises.

The future isn’t evenly distributed yet. But after last week, it’s arriving faster than most people expected.

Chantal Emmanuel is a co-founder of BAMPT, where she helps service businesses implement AI-powered operations. She’s writes about automation, systems thinking, and building businesses that scale.